Professional Financial Programs

Professional financial programs must be discussed and prepared by a certified financial planner (F.Pl.) who has been granted a diploma from the Institut québécois de la planification financière (IQPF) and must be registered with the Autorité des marchés financiers (AMF).

A certified financial planner who will expertly advise you and help you reach your financial goals. A financial planner who can take care of the financial aspects of your estate planning and who can act between you and a lawyer or a notary regarding legal documents and between you and your accountant regarding tax issues.

Also according to the AMF, financial planners (F.Pl.) are individuals who help create financial plans by preparing an action plan adapted to your personal investment requirements, constraints and objectives. A financial planner who must be authorized to operate in financial planning.

Professional Financial Advice

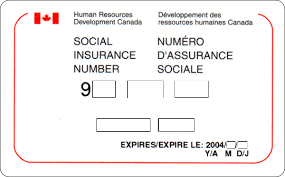

FIRST, as a Canadian resident, you need to prepare a detailed inventory of your assets and liabilities, especially if your assets are scattered in different bank accounts, safety deposit boxes and locations such as your home or your computer.

SECOND you must define your estate planning goals. There are many potential goals to be considered, and you need to consider both the personal and the financial objectives you wish to achieve.

While developing your estate plan you might want to reflect on:

- the beneficiaries of your estate,

- the impact on your family,

- the number of years you intend to support them,

- significant family assets that need to be addressed,

- the importance of income tax and probate taxes,

- immediate inheritance or at a specific date,

- charities you wish to support,

- beneficiaries with special needs...

Professional Financial Information

THIRD once you have clearly defined your estate objectives based on your current financial situation, you need to evaluate your goals and determine how they can be achieved. You also need to consider other factors such as inflation, tax liabilities due to the deemed disposition rules, provincial or territorial succession and family law legislation.

FOURTH your action plan is the result of the objectives you determined in step TWO and the estate evaluation you conducted in step THREE, followed by the preparation of your will or testament or by a review of the document. A significant number of potential issues can be resolved with a well constructed testament.

Other elements of your revision may include changes in the legal ownership of your assets, a review of beneficiary designations for your registered saving plans and life insurance policies, the purchase of additional insurance to address estate preservation goals, donations of various assets prior to death...

Professional Financial Requirements

FIFTH is crucial in making sure your estate plan is properly implemented. You will probably require the assistance of several professionals who must have expertise in estate planning. Professionals such as an estate lawyer or a notary, an accountant, a financial planner, possibly a trust officer and your bank advisor.

SIXTH your estate plan should periodically be reviewed. Changes in legislation or in your financial and personal situation may require changes to your estate plan. Periodic revisions must ensure that your estate plan is still achieving the objectives previously set in step TWO.

Professional Financial Standards

Remember, your personal analyst financial planner must understand the legal requirements related to your financial planning, must properly explain your rights and your responsibilities regarding all the basic financial concepts and must establish an ethical and trustful relationship with you.

Montreal Kits

Professional Financial Programs

Disclaimer Keep in Touch! Montreal Tourism

Privacy Policy Rachel Louise Barry Sitemap

Montreal Kits © All Rights Reserved 2018-2024

The information provided by Montreal Kits is informational only and has no legal value.